10 tasks for future entrepreneurs

Selling lemonade, delivering newspapers, mowing neighbourhood lawns… Most of us have been entrepreneurs at least one summer in our lives. If you still cherish the dream of running your own business, read this—perhaps while sipping a cold drink sold by the kids next door!

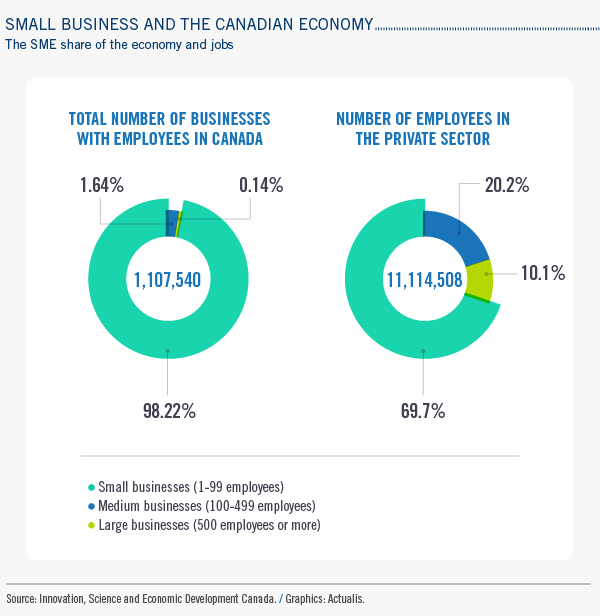

You often hear that small businesses are the heart of the Canadian economy. But how many are there, exactly? Here are a few figures for a clearer picture.

As you can see, small and medium businesses play a key role in our economy. Do you feel like you should be one of them? If so, here are 10 things to remember before you make your move.

- Surround yourself with the right people

Successful entrepreneurs are often those who use the services of qualified professionals to make sure they get started on the right foot. These include accountants, tax experts, lawyers, notaries, financial advisors and other specialized consultants. You can also ask one of them to serve as quarterback to organize and synthesize all the advice you receive. - Draft a business plan

A good business plan explains what you want to do and how you intend to do it. In particular, it includes details about the organizational structure, marketing plan and financial forecasts of the business. Many websites, such as Canada Business Network, offer examples and templates that can help you get a good start. - Get financing

Aside from banks and credit unions, other business assistance organizations offer start-up financing, such as Futurpreneur Canada and business incubators and accelerators. A number of government agencies, such as the Business Development Bank of Canada and the Réseau des SADC & CAE also offer business loans. - Think digital

It’s hard to be in business nowadays without a good digital marketing strategy. After the all-important website, you might want to think about search engine optimization, and how to convert visits to your website into business for your company. Consider online applications, too: many services (project management, time management, billing, online sales, etc.) are now available in the cloud for a minimal monthly fee. But beware! The web also exposes your company to the dangers of fraud and piracy. You may want to learn more about cyber security, particularly if you offer online transactions. - Work the network

Networking can help you expand your pool of potential clients and create business opportunities. Conferences, workshops, trade shows and events organized by chambers of commerce or professional associations are excellent places to start. - Delegate

Handling everything by yourself can be a crushing responsibility. You may want to lighten your load by delegating certain tasks to employees or suppliers with the right skills. Figure out where you are not indispensable and shorten your to-do list. - Manage your billing

A healthy cash flow is critical to every business. To keep the money coming in, it’s a good idea to invoice on delivery, and make sure that invoices are properly numbered, with payment terms clearly stated on them, including penalties for late payment. - Handle fluctuating revenues

Even with good billing practices, all businesses go through cycles–especially one-person businesses. To get through the lean periods, experts recommend drawing up a budget and sticking to it, building a reserve fund, and resisting the urge to spend unreasonably when larger sums are coming in. - Protect yourself

What would happen if you or an essential employee were unable to work for a long period of time, or even worse, what if you died? Insurance is available to protect a business under such circumstances. Disability insurance, key person insurance, payment protection insurance and credit line insurance are among the many products designed to meet the needs of entrepreneurs. - Think about the future

Finally, it is generally recommended that you start thinking early about later on. A weak financial structure or business finances that are poorly matched to your family situation could have consequences 25 or 30 years down the road. In business, retirement, estate planning and succession can often be things to think about right from the very beginning!

So—now that you have a few basics to help you get going, why not take advantage of the summer to fine-tune your project?

But first, go enjoy that lemonade!

The following sources were used in preparing this article. Business Development Bank of Canada, “Business loans. Financing solutions for entrepreneurs.”; “How to build a website for your business”; “Six strategies for improving your business networking skills”; “Nine ways to strengthen your business through better delegation.” Innovation, Science and Economic Development Canada, Key Small Business Statistics – August 2013. Les Affaires, “Entrepreneurs : êtes-vous suffisamment assures ?” (Entrepreneurs: Do you have enough insurance?), November 2015. Question Retraite, “Travailleur autonome et retraite” (Self-employment and retirement). Canada Business Network, “Sample business plans and templates”; “Networking to expand your business,” Blog, April 20, 2010.